Using The Best Confirmation of Payee Algorithm Is The Only Way For PSPs To Avoid Immense Losses Due To APP Fraud Liability

With the new regulatory plans, the role and financial responsibility of Payment Service Providers (PSPs) will change. It will become increasingly important that PSPs use a Confirmation of Payee tool with the very best and most reliable algorithm. As PSPs will be liable for fraud losses, this is the only way to prevent immense financial and reputational damage.

It pays to get started now

The Payment Systems Regulator (PSR) plans to introduce a mandatory refund for victims of Authorised Push Payment (APP) fraud. This is a type of fraud where a victim is tricked into authorising a payment to a fraudster.

The PSR’s proposed refund scheme aims to provide greater protection for consumers and increase confidence in the payment system. APP fraud is the largest type of payment fraud in the UK, with losses totalling £249.1 million in the first half year of 2022. Despite the overall decrease in APP fraud, the amount returned to customers has increased, rising by 11 per cent to £140.1 million in the first half of 2022 or 56 per cent of the total loss.

Source: UK.Finance

The main change for PSPs is that they will be liable for fraud. With a Confirmation of Payee tool, a huge amount of fraudulent payments can be prevented. But one thing is crucial: PSPs have to be sure that the algorithm behind the tool is up-to-date and fully reliable. If it is not, the financial and reputational damage can be immense.

Prevention is key

The PSR’s proposed refund scheme is an important step towards improving consumer protection in the payment system and reducing the impact of APP fraud. However, prevention remains the best defence against fraud. Currently, only 46% of total APP fraud losses are reimbursed to the victim, highlighting the need for greater consumer protection in the payment system.

With SurePay’s Confirmation of Payee solution, consumers can take an active role in protecting themselves when making online payments, giving them peace of mind and security. The solution makes payments even more secure by verifying that the payee’s name and account number match.

This verification process provides a notification if there is a mismatch, allowing users to verify that they are paying the right person or company. A particularly useful feature in preventing APP fraud, as it ensures that the recipient of a payment is legitimate.

The most effective is using the Best in Class solution

Under the Payment Systems Regulator’s proposed scheme, victims of APP fraud would be reimbursed by their payment service provider (PSP) — unless the PSP can prove that the victim did not take reasonable care to protect themselves.

Refunds would be made within 15 working days after the fraud is reported to the PSP. The PSRs’ plans also include measures to prevent and detect fraud, such as improving the ability of PSPs to identify and block fraudulent payments.

So, using a Confirmation of Payee tool is one of the most effective measures PSPs can take.

SurePay’s Confirmation of Payee matching algorithm combines cutting-edge data science techniques with in-depth knowledge of transactions and payer behaviour to help prevent fraud and errors while facilitating Straight Through Processing.

The SurePay algorithm is built from the ground up specifically for Confirmation of Payee.

- Each check is accurate to avoid false positives or false negatives.

It looks simple, but it’s quite complex, for example Elisabeth matches Betty, but we also take into account initials, joint accounts, abbreviations, truncations, out of order and many other human inconsistencies. These matches and close matches can only be recognised by the SurePay algorithm, other tools cannot offer this level of accuracy.

Facts speak for themselves

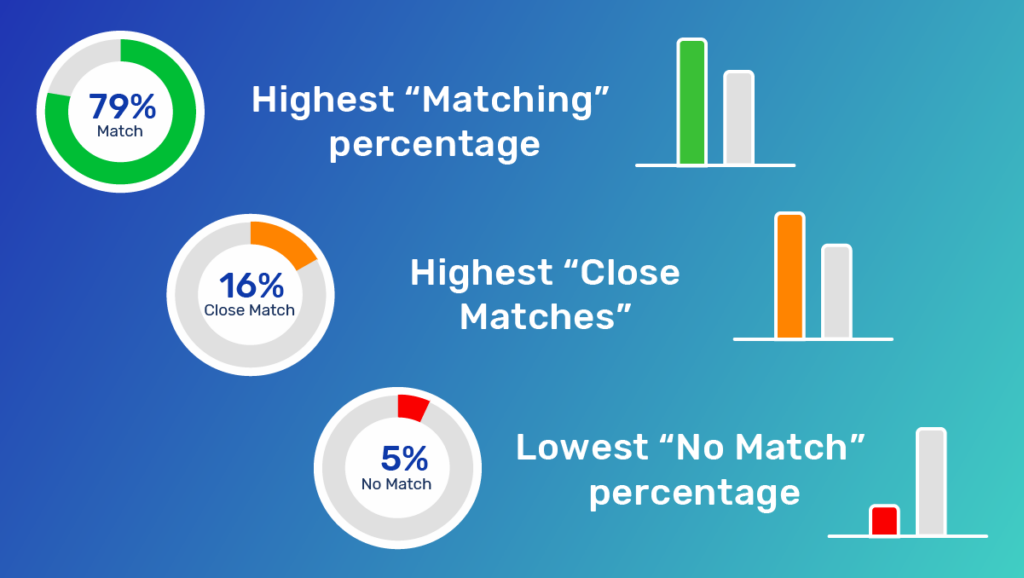

SurePay performs over 600,000 checks per day in the UK and is the best in class provider of payment verification services. In addition to experience, SurePay has one of the highest “match” and “close match” rates in the market. This demonstrates the confidence and security of SurePay’s algorithm. Also, SurePay has worked closely with Pay.UK to launch its Confirmation of Payee solution, which has been instrumental in reducing the impact of APP fraud in the UK.

With the PSR’s proposed refund scheme and the benefit of SurePay’s Confirmation of Payee solution, consumers can feel more confident and secure when making online payments.

More information or want to schedule a meeting/demo? Please use this link: https://meetings-eu1.hubspot.com/louise-astbury