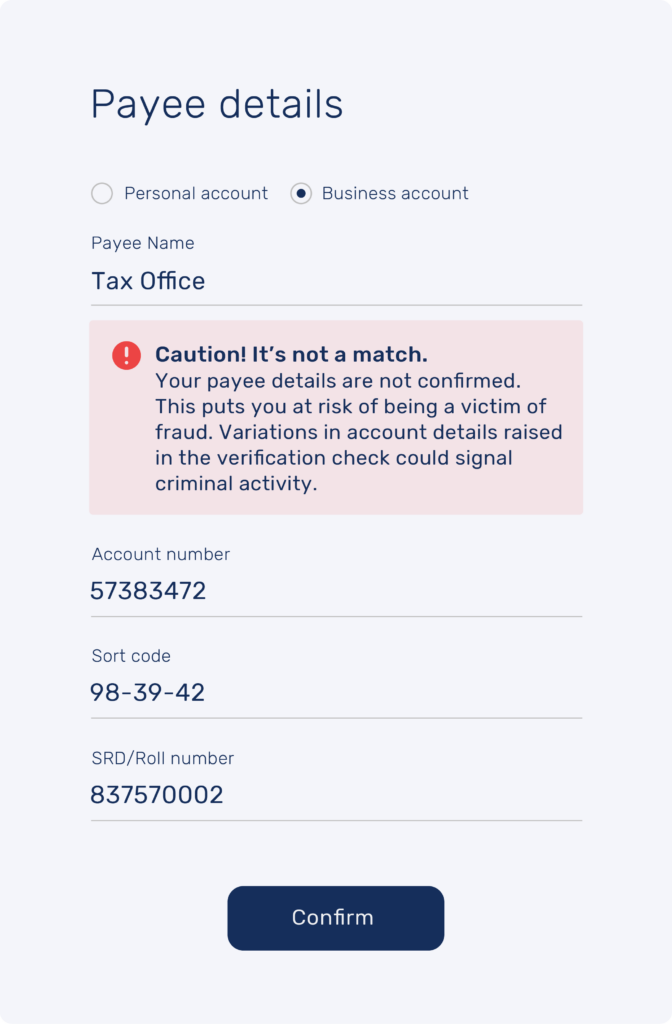

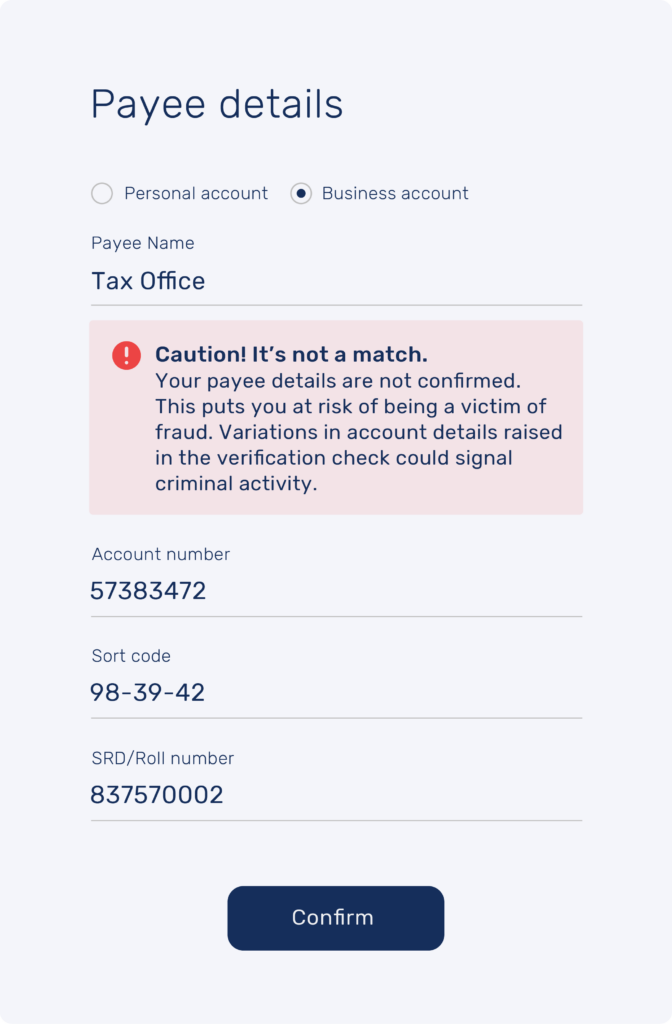

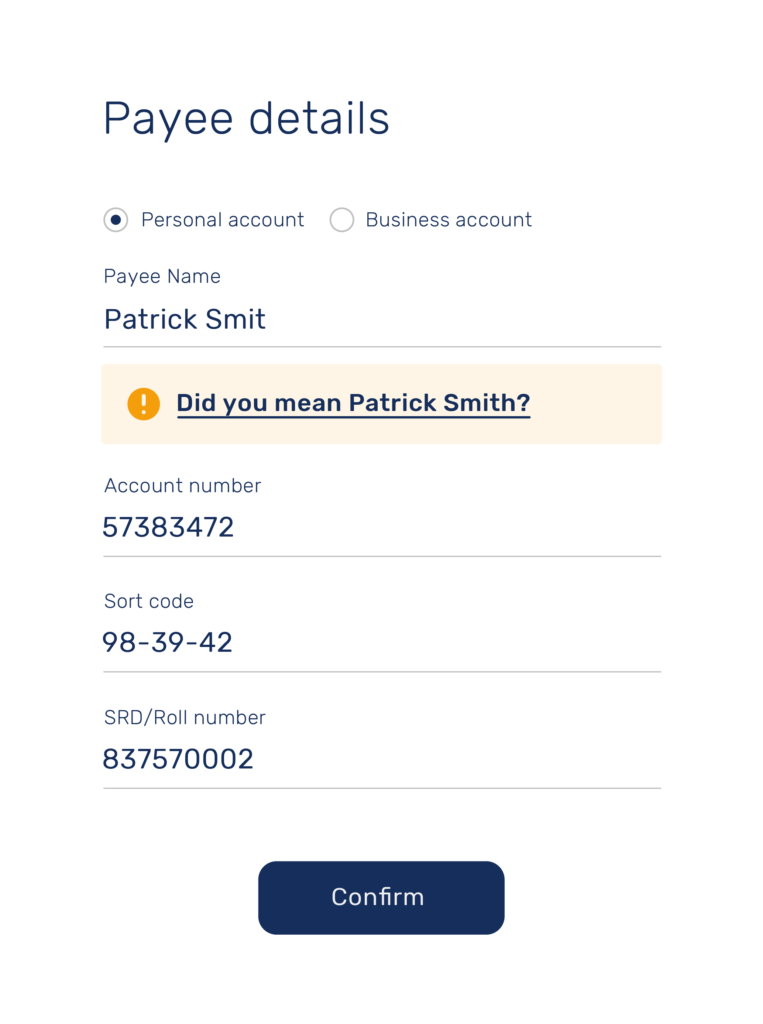

Confirmation of Payee

For PSPs

Seamless integration

Become CoP compliant

Tailored CoP solution for PSPs

Prevent APP fraud

Become CoP compliant

SurePay allows PSPs to offer Pay.UK’s Confirmation of Payee solution to their customers.

“Book a Meeting to start your CoP Journey with us today!”

– Louise Astbury, SurePay

Knowing your CoP needs helps us implement the right solution. PSPs will need to be able to send and respond to CoP requests to and from other banks and PSPs. Book a meeting with us to start your CoP journey.

When you decide to implement our solution, SurePay will inform Pay.UK on your behalf. Pay.UK is the recognised operator and standards body for the UK’s interbank payment system, and enrolment is mandatory for all firms required to implement CoP.

SurePay’s CoP experts will work with your team to plan out a strategy for your CoP implementation, laying out key timelines and a target implementation date.

Implementation involves the deployment and integration of a SurePay CoP solution with your existing systems and processes.

Once the implementation is complete, the CoP solution is thoroughly tested and evaluated to ensure it meets your CoP requirements.

The final step once everything has been implemented and approved is to go live. Once live, your CoP system will begin sending and responding to CoP requests from other PSPs.

As the market leader, SurePay is experienced in providing you with a range of ‘Plug and Play’ solutions that remove the costs and implementation barriers. While ensuring that no matter what CoP solution you decide upon, it can be fully integrated, taking you a step closer to a frictionless payment journey.

Limit fraudsters’ options

Book a meeting →

© 2025 SurePay B.V. All rights reserved