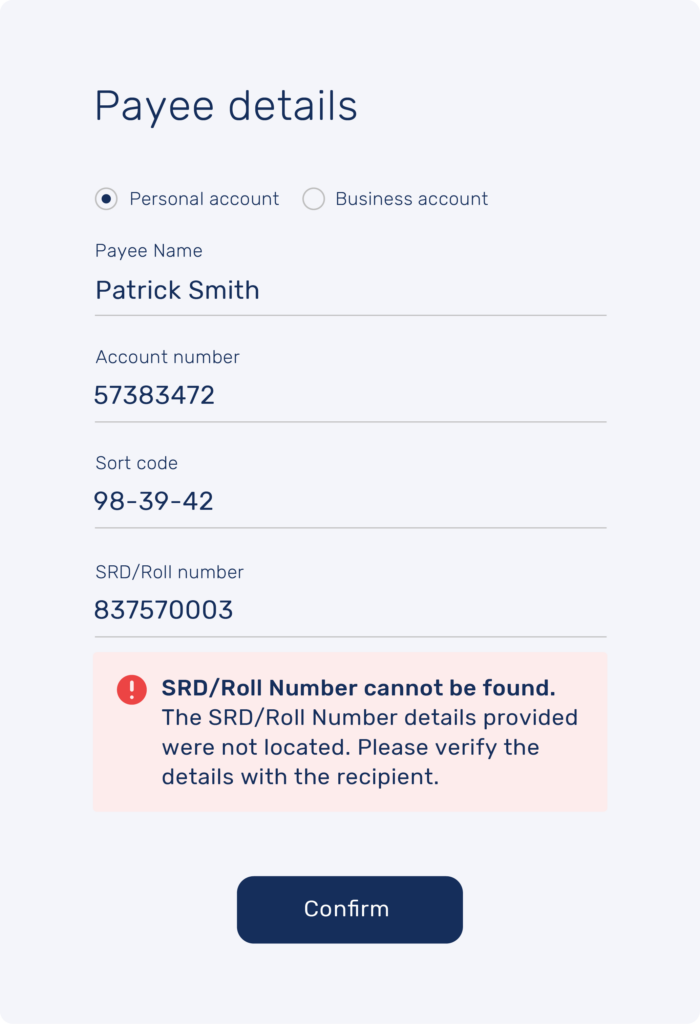

Confirmation of Payee

for Building Societies and Credit Unions

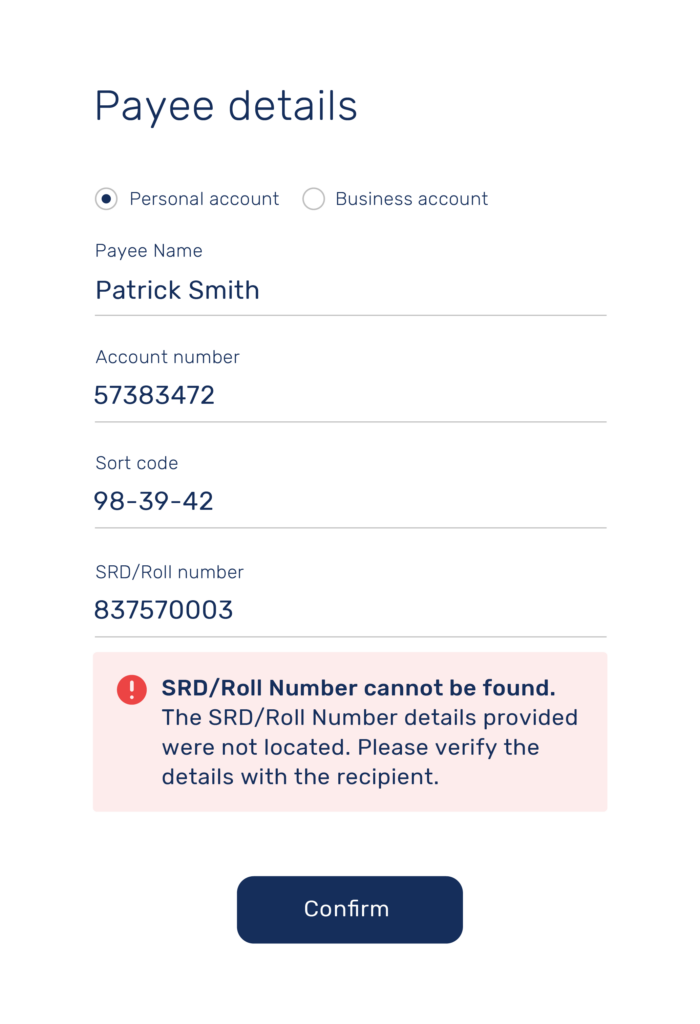

Integrate CoP seamlessly into your existing systems

Tailored CoP solutions to suit your needs

Become CoP compliant on time

Prevent misdirected payments