The One-Stop, Simple Approach to Confirmation of Payee (CoP) Implementation

This article explains the basics of CoP and how SurePay, the UK leading vendor, can help you implement a CoP solution and ensure that you comply with the PSR mandate.

The rise of APP fraud has led to the implementation of Confirmation of Payee (CoP) being mandated by UK regulators(PSR). If you’re a firm that has been told they need to implement CoP, you might be thinking, “well, now what?”

Understand how SurePay’s cutting-edge technology goes above and beyond to offer you a complete CoP solution that integrates seamlessly with your existing systems, and provides a powerful layer of security against payment fraud.

What is Confirmation of Payee?

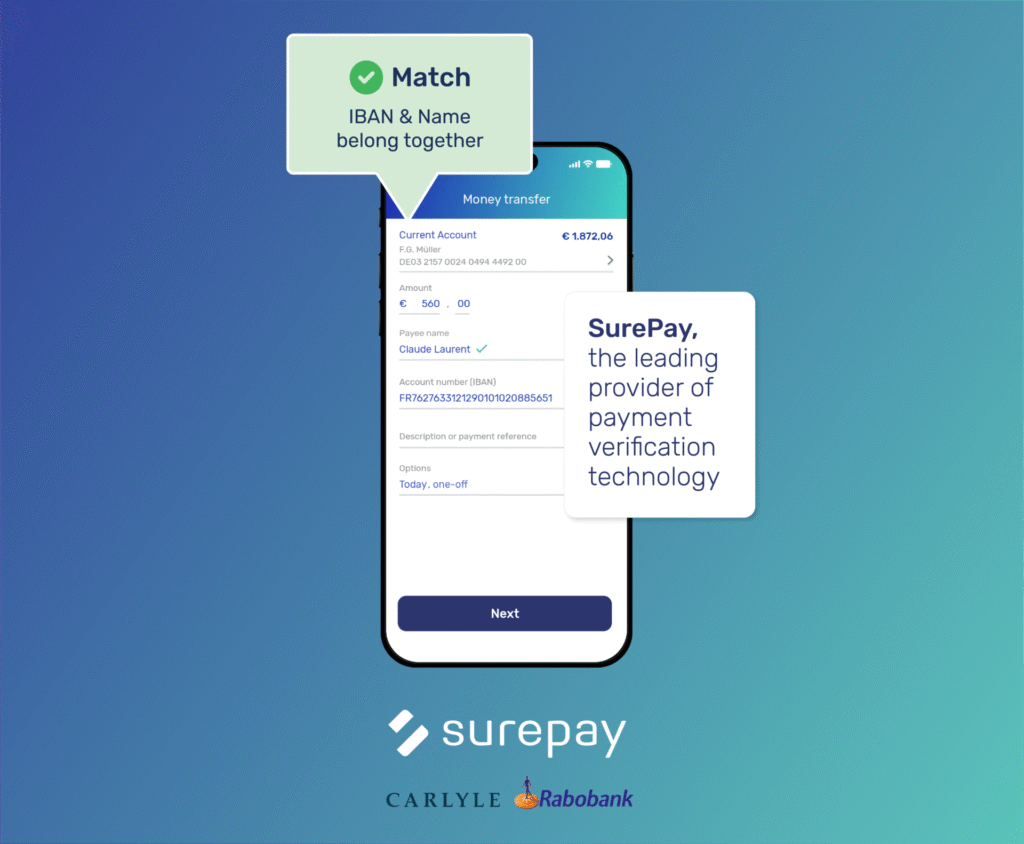

Confirmation of Payee (CoP) is fundamentally a name-checking service for UK-based payments that provides financial services customers with assurance that they’re sending funds to the intended recipient.

Over the last four years, CoP has been gradually introduced across UK banks and PSPs, and its implementation is now mandated by the UK Payment Systems Regulator (PSR) for all payment service providers. With the implementation of the CoP integrated across all banking and PSPs in recent years, PSR issued Specific Direction 17 (SD17) in October 2022. This directive marks an important milestone in the adoption of CoP in the regulatory framework.

Implementation Deadline for PSR Group 2

The implementation of CoP was first mandated by the PSR in March 2020, when it used its regulatory powers to require the UK’s six largest banking groups to introduce CoP by the end of March 2020. This mandate was an overwhelming success, leading to 92% coverage of UK banking customers.

Following this, faced with growing APP fraud figures, the PSR identified two groups of firms that also needed to implement a CoP system with send and respond capability, and set hard deadlines for doing so:

- Larger firms and payment services providers where the impact of APP fraud could be significant.

- All other firms and PSPs that use unique sort codes or are building societies using alternative reference information.

Why Implement Now?

With less than one year to go, all financial services firms must now think seriously about how they’re going to implement a CoP system that conforms with regulatory requirements.

Although the deadline for PSPs that are mandated is not due until 31 October 2024, this is the final implementation date. In other words, you must be able to send CoP requests to other banks and PSPs to verify beneficiary details and receive and respond to CoP requests, too.

Getting started now means that you’ll be able to do this before the deadline date and avoid potential regulatory penalties. In addition, as we move towards the October 2024 deadline, there’s a lot of implementation work to be done. This might lead to longer waiting and implementation times. Starting now will help to avoid the impact of this.

How to Implement Confirmation of Payee

You’ve got two choices when it comes to implementing CoP:

- Build your own in-house solution, or

- Partner with a CoP solutions provider like SurePay.

The latter option is likely to be the most realistic for Group 2 PSPs due to the significant cost and time involved in not only building and rolling out a bespoke CoP solution that meets regulatory requirements but also maintaining it.

As the pioneer and market leader in CoP, we’ve played a fundamental role in shaping CoP services in the UK and Europe, helping thousands of banks, PSPs, and other firms to meet emerging CoP requirements.

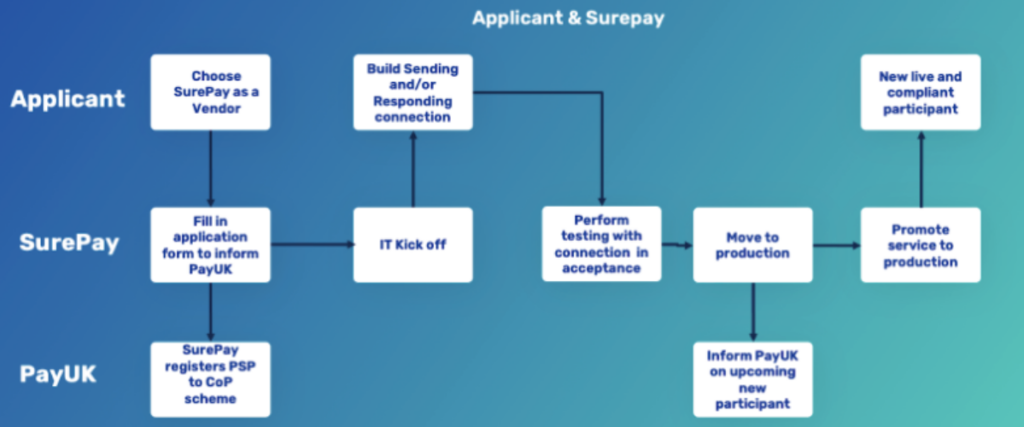

Implementing SurePay CoP is a simple six-step process that begins with understanding your CoP needs.

- Understand Your CoP Needs: Knowing your CoP needs helps us implement the right solution. Group 2 firms will need to be able to send and respond to CoP requests to and from other banks and PSPs.

- Inform Pay UK: SurePay will inform Pay UK on your behalf. Pay UK is the recognised operator and standards body for the UK’s interbank payment system, and enrolment is mandatory for all firms required to implement CoP.

- Project Planning: SurePay’s CoP experts will work with your team to plan out a strategy for your CoP implementation, laying out key timelines and a target implementation date.

- Implementation: Implementation involves the deployment and integration of a SurePay CoP solution with your existing systems and processes.

- CoP Acceptance: Once the implementation is complete, the CoP solution is thoroughly tested and evaluated to ensure it meets your CoP requirements.

- Go Live: The final step once everything has been implemented and approved is to go live. Once live, your CoP system will begin sending and responding to CoP requests from other PSPs.

Throughout the process, your dedicated CoP expert will be on hand to see it through to completion. Alternatively, with the SurePay Developer Portal, you can implement the SurePay CoP solution directly into your systems yourself.

Whatever your needs, we’ve got the right CoP solution to help you achieve complete compliance with PSR requirements.

SurePay understands that innovation within the industry is an ongoing process. That is why we go above and beyond the mandatory steps, helping you leverage the CoP solution for broader applications inside your organisation.

Our team works with yours to identify ways to expand the functionality and benefits of CoP implementation across many aspects of your organisation. SurePay is committed to ensuring your CoP solution becomes a versatile tool for your continuous success, whether it’s by improving security, optimising operations, or exploring new possibilities for collaboration within the payments landscape.

SurePay CoP for Banks and PSPs

expertise in rolling out our technology across the UK and Europe puts us in a position to offer a fast, seamless, and best-in-class CoP implementation for banks and PSPs ahead of the October 2024 deadline.

As for our European solution, more than 7 Billion IBAN-Name Checks have been carried out to date, leading to an up to 80% decrease in instances of fraud and misdirected payments. Get started now to help protect your customers, reduce operational costs, and ensure timely compliance with upcoming PSR requirements.