Confirmation of Payee solution for PSPs

With the Group 2 deadline to implement Confirmation of Payee (CoP) by October 31, 2024 quickly approaching, nearly 300 Payment Service Providers (PSPs) are actively planning to become compliant. This blog serves as a guide on how Group 2 can prepare on time, the latest updates from Pay.UK, and the importance of becoming compliant on time.

Choose your CoP Vendor

The first step in Group 2’s journey to CoP compliance is to understand PayUK’s specific requirements. After that, they have to choose a CoP vendor, such as by outsourcing the service to an aggregator like SurePay.

Our experts can help you and direct you to a solution that is right for you as PSP.

Direct vs. aggregator model

Pay.UK requires Group 2 to confirm their intention to join CoP either through an aggregator or directly before April. How do you know which one is most suited for your PSP?

Direct or Aggregator

Let SurePay experts guide you though what is best for you as a PSP. We are the experienced CoP provider in the market and are available to support you asap.

Our experts can help you and direct you to a solution that is right for you as PSP.

SurePay's CoP Solution

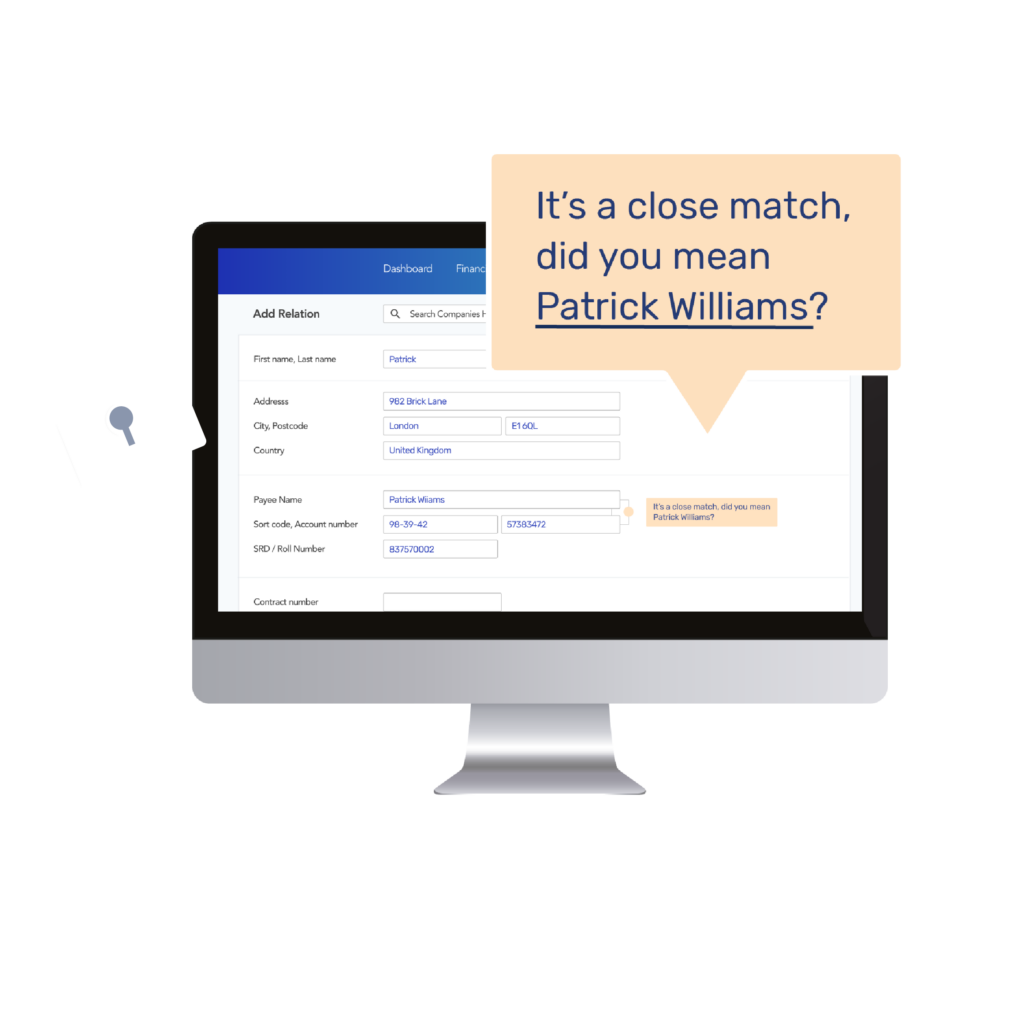

SurePay CoP is a market-leading solution for reducing the risks of misdirected payments and Authorised Push Payment (APP) scams. SurePay’s best-in-class solution not only meets Pay.UK’s CoP requirements, but also exceeds expectations by offering a safe, seamless, and user-friendly CoP implementation for PSPs ahead of the October 2024 deadline.

You can read more on this in the Confirmation of Payee solution for PSPs whitepaper by SurePay.

Introduction to Confirmation of Payee solution for PSPs whitepaper

Are you ready to dive deeper into CoP for PSP? Read our white paper and join us as we explore how CoP addresses the challenges of secure payment transactions in accordance with the Pay.UK mandate, and discover how SurePay can help PSPs become compliant on time.